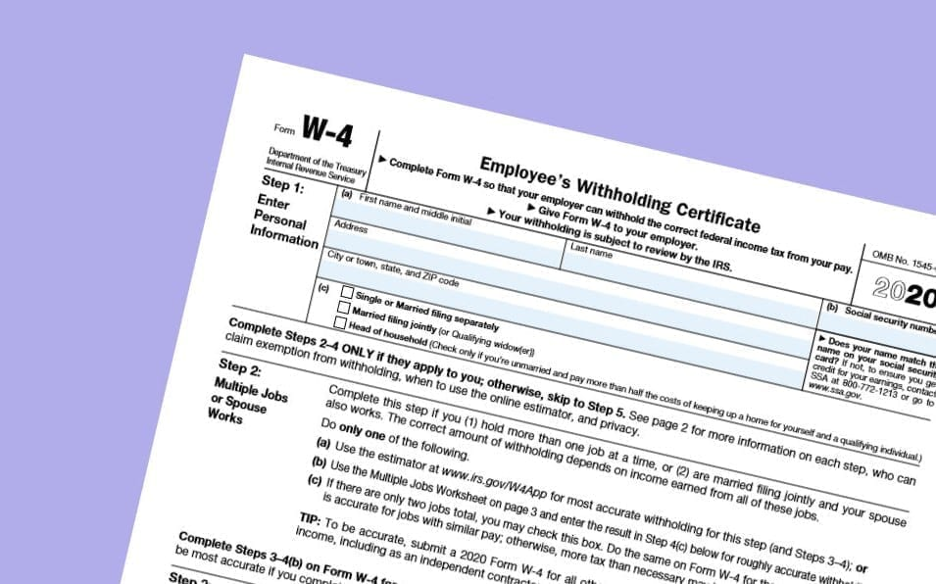

If you are going to work in the United States, your employer will ask you to fill out a special Form W-4. It calculates how much tax will be deducted from your salary. By filling out the W-4, you can also determine which income tax rebates you may be entitled to.

Method 1: Filling in the Personal Allowance Worksheet part

- Be sure to read the instructions for filling out the form provided at the top of the form. Keep in mind that the more discounts you require, the less money will be withheld from your salary in the form of taxes.

- Determine if you are a dependent. If you are not a dependent, then put the number “1” in the cell opposite the letter A.

- Enter in the cells additional information regarding discounts, if they are applicable to you.

- Include discounts on your spouse, children, and other dependents you support.

- Determine if you can be considered the Head of the Household. This information should be provided to people who are not married and who spend at least half of their income on dependents.

- Add a discount if you have a child, there will be additional costs associated with the dependent, or if you are going to take out a tax credit.

-Determine how many discounts you are entitled to, depending on the amount that the tax service will return to you (the so-called tax refund), as well as if you owe tax for the previous year.

- Add discounts if you’ve received a large refund from the IRS and you’d like to have less money withheld from your salary. The more discounts you have, the fewer taxes will be withheld from you.

- Reduce the number of discounts if you had to pay taxes in the previous year. The more money will be withheld from your salary, the less you will owe the IRS at the end of the year.

- Count the number of discounts you have claimed and enter this number next to the letter H. You should also put this number next to the number 5 in your W-4 form.

Method 2: Filling in part of employee’s Withholding Allowance Certificate

- Fill in your personal information. You’ll need to provide your name, address, and Social Security number.

- Indicate if you are married or not. If you are married, you will have the opportunity to pay fewer taxes.

- Check in the box that you are not married if you are married but legally separate, or if you are married, but your spouse is not a U.S. resident.

- Write down the total number of discounts you’ve determined by filling out the form.

- Determine if you want to have any additional amounts withheld from your salary, for example, if you owe the tax service or if you want to receive a larger refund (tax refund). Enter this amount in dollars.

- Read the Exemption Claim. In order for you not to withhold extra money from your salary, you should not have any debts to the tax service.

- Sign the form and put a number. Give the form to the employer. This form is usually required in the human resources department or in the accounting department.

Tips

- Form W-4 can be updated annually. You can make changes to it; for example, if you got married or divorced, you had a child, or there were other changes that may affect your taxes.