Dealing with taxes rarely features at the top of anyone’s list of enjoyable things to do. However, it is a necessary evil so the sooner one can get it out of the way, the better. Things get a little more complicated when you are an independent contractor or freelancer. In such cases, you’ll find that most clients will ask to have a Form W-9 completed. This form is also known as a Request for Taxpayer Identification Number (TIN). Its purpose is to allow businesses to collate key pieces of information from their vendors in preparation for filing their returns with the IRS.

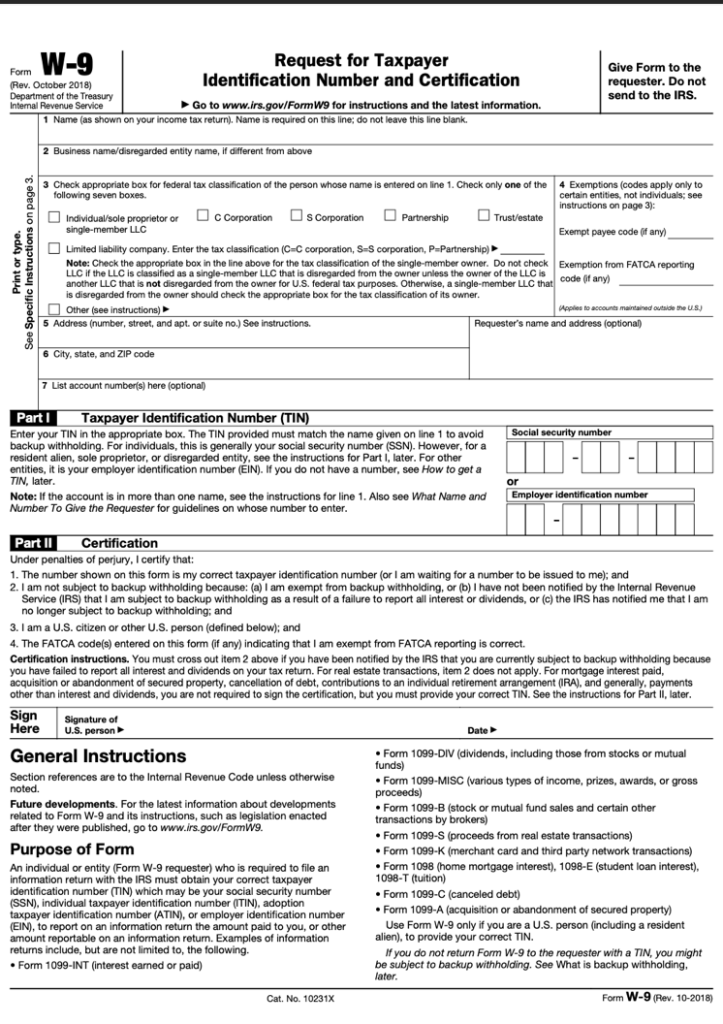

First things first, here is a blank template of the W9-Form which is worth keeping close to hand.

| Language | Free |

| Release Date | October 2018 |

| Genre | tax |

| Author | IRS |

| File Size | irs.gov |

| Rating | (4.8) |

It is normal for people to feel overwhelmed when filing for anything to do with taxation. However, you’ll probably find that Form W-9 is actually pretty straightforward. In fact, the form isn’t even a whole page long, if you exclude the instructor. The company hiring you should fill in its name and employer identification number (EIN). Once, that is done, you can meticulously fill in the form line by line. So don’t put it off. The sooner you get started, the sooner you’ll realise how easy it is.

Getting your tax paperwork in order quickly will also help reduce the stress involved in the task of completing your W-9 Form. Having everything in order will make it easier for you to do the calculations, gather the information and submit your paperwork on time. If you find it all too much, a financial advisor will be a great asset.

Although, they request a lot of the same basic information such as your name, address and social security number, a W-9 and W-4 form serve different purposes. A W-4 needs to be completed by those who’ve just taken up full-time employment or when there has been a change in a person’s financial situation. Essentially, a W-4 form helps employers establish how much to withhold from an employee’s paycheck to cover federal income taxes. W-9 forms aren’t filled in by full-time employees but by contractors because employers don’t withhold income tax from freelancers in the same way.

In short, a W-9 form is an essential part of filing your taxes as a freelancer. It basically serves as an agreement to your employers to state you’ll take responsibility for your own taxes and there is no need for them to withhold funds. With that said, you don’t need to send the W-9 Form to the IRS yourself but instead, give it to your employer. It is a relatively easy form to complete, you just need to ensure all the information is correct. If all else fails, contact a financial advisor for advice. Good luck.